Overall, IC Markets can be summarised as a trustworthy and highly regulated Forex Broker that is very competitive regarding its trading fees. IC Markets offers access to an extensive range of financial instruments and has a 94 out of 99 trust score.

- Raw spreads means really from 0.0 pips

- Our diverse and proprietary liquidity mix keeps spreads tight 24/5

- Average execution speeds of under 40ms***

- Low latency fibre optic and Equinix NY4 server

- Low latency fibre optic and Equinix NY4 server

- High minimum deposit requirement

- No investor protection for non-EU customers

IC Markets Overview

IC Markets, established in 2007, is a well-regarded online trading broker serving over 1 million active traders globally. Based in Seychelles and regulated by the Financial Services Authority (FSA), the broker provides a secure and efficient trading environment. IC Markets ensures investor protection through features such as segregated accounts, negative balance protection, and compliance with relevant regulations.

The broker offers a wide range of trading instruments, including CFDs on major and minor currency pairs, global stock indices, commodities, and shares, with spreads starting from as low as 0.0 pips. IC Markets supports several popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, catering to traders’ various preferences across multiple devices.

| 🔎Broker | 🥇 IC Markets |

| 📌 Year Founded | 2007 |

| 👤 Amount of Active Traders | Over 1 million |

| 📍 Publicly Traded | None |

| 🛡️ Regulation | FSA (Seychelles) |

| 🌎 Country of Regulation | Seychelles |

| 🔃 Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🧾 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 💴 Minor Account Currencies | Major and Minor |

| 💶 Minimum Deposit | 200 USD |

| ⚡ Average Deposit/Withdrawal Processing Time | Typically 1-2 business days |

| 💵 Fund Withdrawal Fee | Generally no fee |

| 🔖 Spreads From | From 0.0 pips |

| 💷 Commissions | Variable |

| 🪙 Number of Base Currencies Supported | 10+ |

| 💳 Swap Fees | ✅Yes |

| 🏷️ Leverage | Up to 1:500 |

| 🖇️ Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 🖥️ Order Execution Time | Milliseconds |

| 💻 VPS Hosting | ✅Yes |

| 📈 CFDs Total Offered | Extensive Range |

| 📉 CFD Stock Indices | Major global indices |

| 🍎 CFD Commodities | Oil, gold, etc. |

| 📊 CFD Shares | Major global stocks |

| 💴 Deposit Options | Bank transfer, credit/debit, e-wallets |

| 💶 Withdrawal Options | Bank transfer, credit/debit, e-wallets |

| 🖥️ Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader |

| 💻 OS Compatibility | Windows, macOS, iOS, Android |

| 🖱️ Forex Trading Tools | Advanced charting tools, etc. |

| 🥰 Live Chat Availability | ✅Yes |

| ☎️ Customer Support Contact Number | Varies by region |

| 💙 Social Media Platforms | Twitter, Facebook, LinkedIn, Instagram |

| 😎 Languages Supported | Multiple Languages |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | ✅Yes |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Numerous global partners |

| 🫰🏻 IB Program | ✅Yes |

| ↪️ Do They Sponsor Any Notable Events or Teams | ✅Yes |

| ⭐ Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Safety and Security

IC Markets operates under the regulation of the Financial Services Authority (FSA) of Seychelles, ensuring compliance with rigorous standards and offering a secure trading environment for its clients. The FSA oversees financial services in Seychelles, promoting fair and transparent markets. IC Markets’ adherence to these regulatory guidelines guarantees that client funds are managed with the highest level of security.

The broker follows the Seychelles Securities Act and implements robust internal risk management controls to maintain adequate capitalization and operational efficiency. External audits further affirm IC Markets’ commitment to regulatory compliance. In addition, client funds are kept in segregated accounts with top-tier banks to provide additional protection. IC Markets also follows Anti-Money Laundering (AML) regulations and has strict Know Your Customer (KYC) policies in place to combat illegal activities.

Minimum Deposit and Account Types

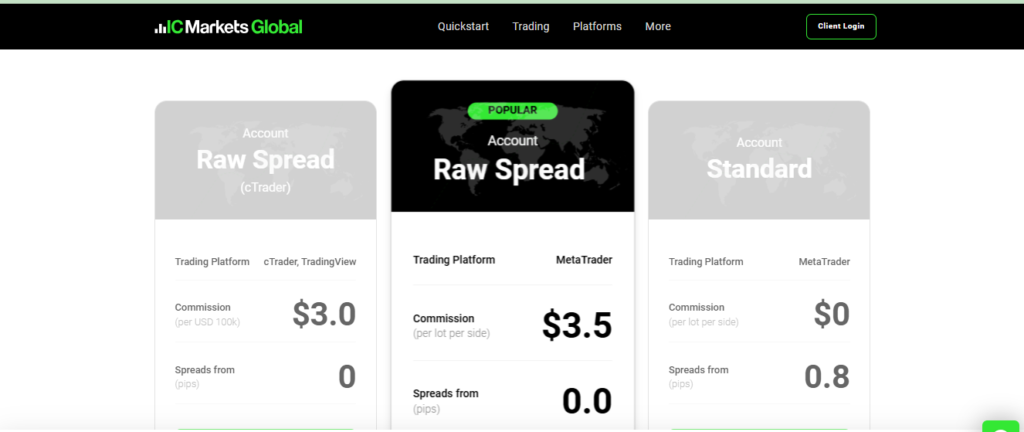

IC Markets offers a variety of account types designed to meet the needs of traders with different levels of experience. The minimum deposit for all account types is $200, making it accessible for both beginners and experienced traders. The broker provides several account options, including the Raw Spread accounts (available on MetaTrader and cTrader platforms) and the Standard account, each offering distinct benefits based on your trading style.

Raw Spread Account

Known for offering some of the lowest spreads, the Raw Spread account features spreads starting from 0.0 pips, with a small commission starting at $3 per 100k traded. This account is ideal for day traders, scalpers, and users of Expert Advisors (EAs).

Standard Account

The Standard account provides a commission-free experience with spreads starting from 0.8 pips. This is suitable for discretionary traders who prefer not to incur additional commission fees.

Islamic Account

IC Markets offers an Islamic version of its Raw Spread account, which is fully Sharia-compliant for traders who require such an account structure.

How To Open an IC Markets Account

To register an account with IC Markets, follow these easy steps:

- Navigate to the IC Markets Website and choose the green “Open a Live Account” option.

- Choose the account that best suits your requirements.

- Complete the application form.

- Fund your account

- Download Your Trading Platform

Trading Platforms

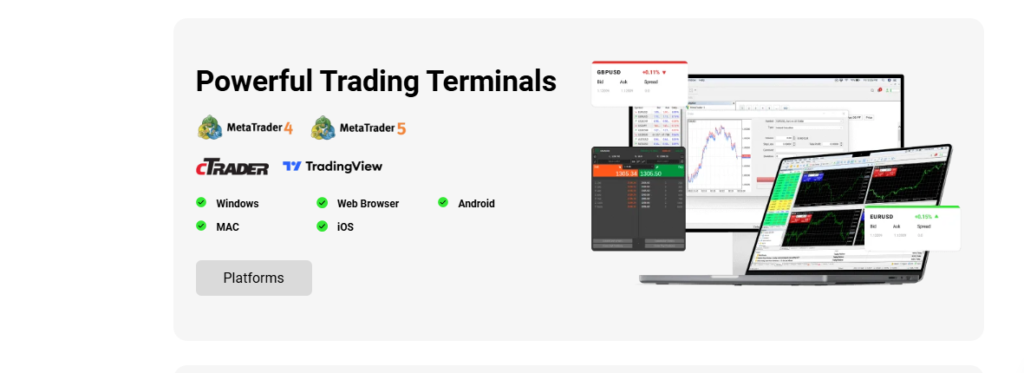

IC Markets offers three advanced and widely recognized trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform is tailored to meet the diverse needs of traders, providing reliable and flexible environments for trading across multiple financial markets.

MetaTrader 4 (MT4)

Renowned for its reliability and flexibility, MT4 is ideal for traders who focus on advanced charting, technical analysis, and automated trading through Expert Advisors (EAs). The platform features an extensive library of indicators, custom scripts, and plugins, allowing traders to personalize their trading experience to align with specific strategies.

MetaTrader 5 (MT5)

Building on the strengths of MT4, MT5 offers enhanced analytical tools, additional timeframes, improved charting capabilities, and multi-asset functionality. It supports seamless trading across Forex, stocks, and futures markets while providing advanced order management and detailed market views to assist traders in making informed decisions.

cTrader

Known for its intuitive interface and user-friendly design, cTrader provides transparent trading conditions with Level II pricing and fast order execution. It supports advanced charting and algorithmic trading, making it an excellent choice for professional traders and those who require customized automated strategies. cTrader is highly regarded for its efficiency and solid performance, especially in executing complex trading strategies.

Fees, Spreads, and Commissions

IC Markets is well-known for offering some of the lowest fees, spreads, and commission structures in the trading industry. The broker’s Raw Spread accounts provide spreads starting from 0.0 pips, among the tightest available in the market.

For the Raw Spread account on MetaTrader, traders are charged a commission starting at $3.50 per lot (per side), while cTrader users are charged $3 per 100k traded.

Raw Spread Account (MetaTrader)

Offers spreads starting from 0.0 pips with a commission of $3.50 per lot (round turn). This account type is ideal for day traders and scalpers who rely on low spreads and minimal trading costs.

Raw Spread Account (cTrader)

Offers spreads from 0.0 pips with a commission of $3 per 100k (round turn), catering to traders who prefer using cTrader as their platform.

Standard Account

This account type has no commission, with spreads starting at 0.8 pips. It is suitable for traders who prefer to avoid additional fees while still benefiting from competitive spreads.

Leverage and Margin

Leverage and margin are crucial concepts in forex trading, directly influencing both potential risk and reward. IC Markets provides a range of leverage options and educational resources to help traders understand and navigate these concepts.

Leverage allows traders to control larger positions with a smaller deposit. For example, with 1:100 leverage, you can control a position worth $10,000 with just $100 in your account. While leverage increases the potential for higher profits, it also amplifies risk.

Deposit and Withdrawal

IC Markets offers a range of convenient deposit and withdrawal methods, making it easy for traders to fund and access their accounts. Available deposit options include Bank Wire, Credit/Debit Cards, Cryptocurrency Wallets, and e-wallets such as PayPal, Skrill, and Neteller. Withdrawals can be made using the same methods, with additional security measures in place to protect transactions.

Educational Resources

IC Markets provides a comprehensive education center to support traders at all levels in mastering forex and CFD trading. The platform offers a variety of resources, including video tutorials and in-depth guides on the fundamentals of forex and CFDs, all designed to enhance your trading skills.

IC Markets offers an excellent range of educational tools that are perfect for traders at any level. Their comprehensive video tutorials, guides, and platform walkthroughs ensure that traders can enhance their knowledge and skills effectively.