FBS is a reliable and well-regulated forex broker, known for its low minimum deposit and broad access to over 240 trading instruments.

- FBS supports more than 100 payment mechanisms, allowing for flexible financial transfers

- FBS is extremely well-regulated globally and has several strict policies in place

- FBS has received multiple industry awards

- FBS has low fees on stock and index CFDs, making it a popular choice for trading these products

- Experienced traders can take advantage of high leverage options, with up to 1:3000 for Forex

- Traders that trade seldom will benefit from the absence of an inactivity fee

- FBS no longer offers copy trading

- FBS’s average Forex spreads may not be competitive in the market

- FBS charges deposit and withdrawal fees on some payment methods

- Negative balance protection will not prevent traders from losing their invested funds

- There is a limited range of tradable instruments compared to other brokers

- FBS only offers one retail trading account

FBS Overview

Founded in 2009, FBS is a well-established forex broker that has served over 27 million active traders worldwide. With a dedicated team of 243 professionals, the company operates under the strict regulations of CySEC (Cyprus), FSC (Belize), and ASIC (Australia), ensuring a high standard of compliance and credibility.

FBS is recognized for its strong focus on security, transparency, and client satisfaction. The broker offers a wide range of account types and trading instruments, including CFDs on stocks, commodities, and indices. It also supports various payment options, provides valuable educational resources, and delivers a full suite of powerful trading platforms. All these features are designed to offer a seamless and trustworthy trading experience for its global clientele.

| 🔎 Broker | 🥇 FBS |

| 📅Year Founded | 2009 |

| 🧑🏻💻Amount of staff | 243 |

| 👩💻Amount of active traders | Over 27 Million |

| 🌐Publicly Traded | None |

| 🛡️Regulation | FSC, CySEC, ASIC |

| 🌎Country of regulation | Cyprus (CySEC), Belize (FSC), Australia (ASIC) |

| 💻Account Segregation | ✅Yes |

| 🪫Negative balance protection | ✅Yes |

| 🔋Investor Protection Schemes | ✅Yes |

| ➕Accounts | Standard Account Cent Account |

| 💳Institutional Accounts | ✅Yes |

| 👨💼Managed Accounts | ✅Yes |

| 📇Minor account currencies | USD, EUR |

| 💰Minimum Deposit | 5 USD |

| 🕞Deposit/withdrawal processing | 1-3 business days |

| 🪙Fund Withdrawal Fee | Free, but may depend on payment method |

| 📊Spreads from | 0.7 pips |

| 💸Commissions | None |

| 💱Number of base currencies | Over 72 |

| 🚀Swap Fees | Overnight financing fees apply |

| 📈Leverage | Up to 1:3000 |

| 📏Margin requirements | 50% |

| ☪️Islamic account (swap-free) | ✅Yes |

| 💻Demo Account | ✅Yes |

| ⌛Order Execution | Typically within milliseconds |

| 📆VPS Hosting | Yes, for eligible clients |

| 🧾CFDs-Total Offered | Over 650+ |

| 🗠CFD Stock Indices | ✅Yes |

| ⚖️CFD Commodities | ✅Yes |

| 📜CFD Shares | ✅Yes |

| 💳Deposit Options | Credit/debit cards, bank transfers, electronic wallets. |

| 💵Withdrawal Options | Must be sent via the same payment method used for deposit |

| 💻Trading Platforms | MetaTrader 4 (MT4) MetaTrader 5 (MT5) |

| 👩💻OS Compatibility | Windows, macOS, Android, iOS, Web |

| 🖥️Forex trading tools | ✅Yes |

| 🗣️Live chat availability | ✅Yes |

| 📱Customer Support email | [email protected] |

| 📞Customer Support Contact | +357 22 010970 |

| 👾Social media Platforms | Facebook, Twitter, Instagram |

| 🗣️Languages supported | 14 Languages |

| 🖺Forex course | ✅Yes |

| 🧏♀️Webinars | ✅Yes |

| 📚Educational Resources | ✅Yes |

| 🪪Affiliate program | ✅Yes |

| 👨🏫Amount of partners | 700 000 |

| 📋IB Program | ✅Yes |

| 🪙Rebate program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Safety and Security

FBS places a strong emphasis on client safety and operates under the regulation of the Financial Services Commission (FSC) in Belize. This regulatory framework ensures the broker complies with international standards for transparency, fairness, and investor protection, including stringent measures against money laundering and terrorist financing.

To further enhance client security, FBS implements key features such as segregated accounts, negative balance protection, and advanced risk management tools. These measures help create a secure and reliable trading environment, reinforcing the broker’s commitment to transparency and regulatory integrity.

Minimum Deposit and Account Types

FBS offers a flexible range of account types, including Cent, Standard, and Demo accounts, designed to cater to traders with different levels of experience. The minimum deposit required to open a live trading account starts at just USD 5, making it highly accessible for beginners.

While the Cent Account requires a minimum of USD 10 and is ideal for those new to trading, the Standard Account, which starts at USD 100, is more suited for experienced traders.

FBS also offers higher leverage options up to 1:500 for those using Leverage Pro conditions.

How To Open an Account

Start the Application Begin the account registration process by clicking the “Open Account” button at the top right corner of the FBS homepage.

Register Complete the registration form with the necessary details, or sign up using your Facebook, Google, or Apple account.

Access the FBS Trader Area Once registration is complete, you’ll be redirected to the Trader Area. Click “Proceed,” and an email confirmation link will be sent to you. Be sure to open the link in the same browser as your Area. After confirming, you can proceed to open your first trading account.

Step 4: Make Your Selections Choose your preferred trading platform, account currency, and leverage. Once you’ve made your selections, click “Open Account” to finalize the setup.

Step 5: Confirmation Congratulations! Your registration is complete. You can now choose to deposit funds or continue to the client area.

Trading Platforms

FBS offers three reliable trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the FBS App. MT4 remains a favorite for traditional Forex traders due to its advanced charting tools and automated trading capabilities.

MT5, on the other hand, is a more advanced platform that includes additional features such as more timeframes, technical indicators, and an economic calendar.

Both platforms support automated trading through Expert Advisors (EAs), and the FBS App provides on-the-go trading for iOS and Android users, ensuring a versatile and convenient trading experience.

Fees, Spreads, and Commissions

FBS provides competitive trading conditions with zero commissions on Forex, indices, commodities, and cryptocurrencies for both Cent and Standard Accounts. Forex trading starts with spreads as low as 0.7 pips on the Standard Account, while indices feature spreads ranging from 1.0 to 1.5 pips.

Stock trading on the Standard Account includes variable commissions, with spreads also between 1.0 and 1.5 pips. For cryptocurrencies, spreads range from 0.5% to 1.0%, and commodities are available with spreads from 1.5 to 2.0 pips. These flexible trading conditions allow traders to select the account type that best aligns with their strategy and goals.

Leverage and Margin

Leverage is an essential feature offered by FBS, enabling traders to control larger positions than their initial deposit would typically allow. With leverage, traders can amplify potential profits, even with smaller amounts. The margin, however, refers to the minimum collateral required to maintain an open leveraged position, which varies based on the deal size and leverage applied.

FBS offers leverage on Forex products ranging from 1:1 up to a significant 1:3000. This flexibility helps traders balance their trading opportunities and manage risk efficiently. Leverage can be adjusted at any time in the Personal Area, with automated adjustments to ensure optimal risk management.

Deposit and Withdrawal

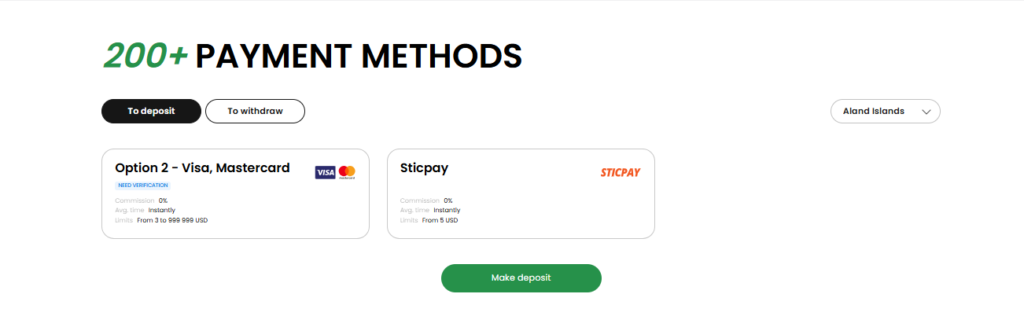

FBS provides a secure and user-friendly system for handling deposits and withdrawals, allowing traders to manage their funds with ease. Once account verification is complete, clients can enjoy unlimited transactions without any commission fees.

The broker supports a wide range of popular payment methods, including Visa, Neteller, Skrill, SticPay, and Perfect Money, for both deposits and withdrawals. Deposits are processed instantly, while withdrawals are typically completed within 15 to 20 minutes, depending on the chosen payment method.

With this efficient and flexible payment system, FBS ensures a smooth and reliable transaction experience for traders around the world.